Article by @Kryptonite0x

Disclaimer : The information provided in

this article does not constitute investment advice, financial advice, or

any other sort of advice and you should not treat any of the website's

content as such. Do your own research and remember this information is

provided for educational purposes only.

This article aims to introduce Bancor, a DeFi protocol currently available on Ethereum. There are two main reasons why this protocol is interesting :

- It offers 20-35% APR on stablecoins.

- It has nice unique mechanisms.

First, we will go through a general presentation on how the Automated Market Maker and liquidity pools work so that everyone can have a clear view (we hope) of DeFi's current problems. Then, we will see what Bancor offers as a solution.

Part I. Decentralized Finance and Bancor Protocol : 20-35% APR on stablecoins

Bancor is an Automated Market Maker (AMM) which allows assets to be traded for others in a completely decentralized way thanks to a liquidity pool system.

Liquidity pools are a great innovation related to blockchain technologies; it is a major component of decentralized finance (DeFi).

To understand the innovation behind this system, we first have to understand how a common trading system works. In traditional finance, players have to go to centralized platforms and place orders to buy/sell assets. There are several platforms: NASDAQ, New York Stock Exchange, Euronext to name a few. All orders are centralized and added to the order book, if one decides to sell an asset at $20 then it is recorded and as soon as a buyer shows up at the same price then the trade is officialized and the transaction is completed. Crypto exchanges like Binance, Coinbase or FTX use this same order book principle.

This system requires several actions that are difficult to set up in DeFi, such as depositing funds on a centralized platform to make a trade, or being able to maintain a system able to "match" different trades in real time. Furthermore, order book works very well for liquid pairs, but is much less efficient for illiquid pairs like we regularly find in DeFi.

This is why AMM and liquidity pools have made a huge difference.

A liquidity pool simply corresponds to funds deposited into a smart contract by liquidity providers. Each time, those providers have to deposit two assets within the liquidity pool:

- 50% of Asset A

- 50% of Asset B

This solution allows other users to trade assets in the pool and liquidity providers to earn trading fees. Liquidity providers are therefore paid to provide liquidity.

Thanks to this system:

- No need to deposit your money on a centralized platform to trade, you can do everything with your browser wallet, and you keep the ownership of your funds.

- There is no need to "match" with another person at the same time to trade, just use the cash in the pool directly.

This elegant mechanism comes with one major problem, which is commonly known as impermanent loss (IL). Simply put, impermanent loss is the % of loss of an asset you deposited into a liquidity pool. This occurs when the value of Asset A increases compared to Asset B and in order to maintain a 50/50 ratio, you may get more Asset B and less Asset A back, resulting in a loss compared to a simple buy and hold strategy. Impermanent loss mainly occurs on volatile pairs, much less for stablecoin pairs (USDC/USDT for example) as there is almost no price variation.

It was essential to present these principles before discussing Bancor, because in addition to offering attractive rates, the protocol has the specificity to protect its users against impermanent loss.

If you want to check the platform and see liquidity pools, you can simply follow this link: https://app.bancor.network/pools

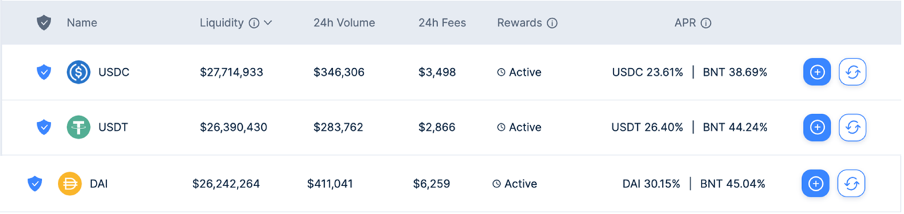

Here are the results for USDC, UST and DAI as of February 12, 2022.

There are 3 important things to understand on this screen:

- This is a single asset deposit :

It means that only one asset can be deposited, there is no longer a 50/50 split between two different assets.

- Pools are protected against impermanent loss

You can see it with the shield symbol:

Extra care about this symbol should be taken as some pools are not protected against IL.

- Rates

Rates on the left correspond to interests received when depositing USDC, USDT or DAI into the pool. For USDC, we can receive an APR of 23.61% paid thanks to trading fees & a BNT token boost offered by the protocol (liquidity mining program).

Rates on the right are rates received if you decide to deposit BNT into this pool instead of USDC, USDT or DAI. We will come back to this in part II.

Therefore, thanks to Bancor we can deposit our stablecoins, be protected against impermanent loss and receive a 20-35% annual return. Now let’s understand how Bancor achieves this.

Part II. Bancor's mechanisms

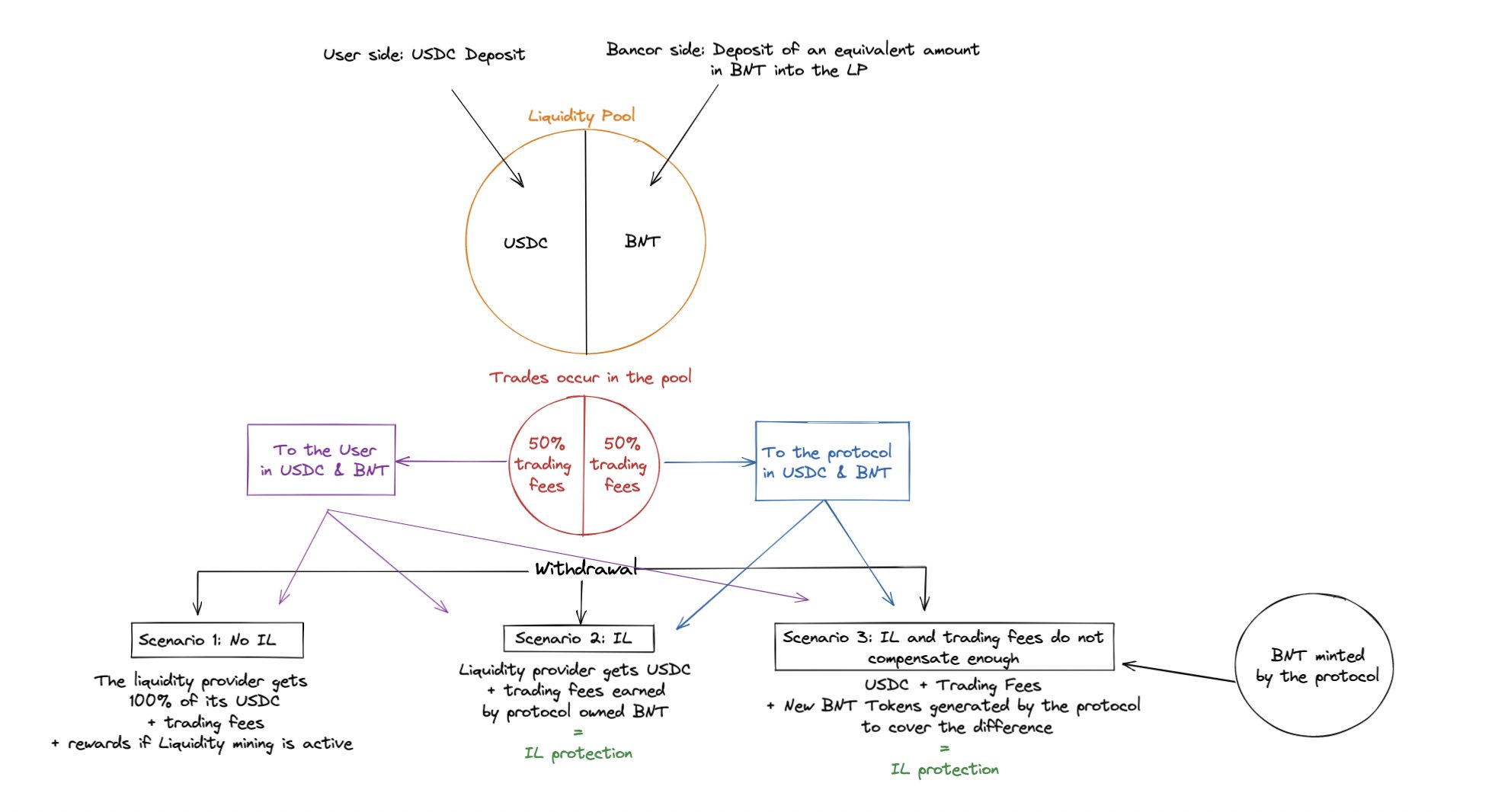

Bancor operates as follows: When a user deposits an asset into a liquidity pool, Bancor adds an equivalent amount of BNT to create the liquidity-providing position.

For example, the USDC pool is composed of USDC deposited by users and an equivalent amount of BNT deposited by the protocol itself. When trades occur in the liquidity pool, both users and the protocol receive trading fees.

As you can understand, since each pool is composed of an asset A and an equivalent amount of BNT, the risk of impermanent loss is still present. Yet, it is Bancor that is responsible for covering this risk.

How does this compensation system work? There are three different scenarios to consider:

- Scenario 1: At the time of withdrawal, there is no impermanent loss

In this case, the user gets his deposit back plus the interest earned

- Scenario 2: At the time of withdrawal, there is impermanent loss

In this case, the user gets his deposit back and the impermanent loss is compensated by the trading fees earned by Bancor on the BNT side of the liquidity pool.

- Scenario 3: At the time of withdrawal, there is an impermanent loss, but the trading fees do not compensate everything

In this case, Bancor will mint new BNT tokens and will pay this BNT to the user so that it fully compensates for impermanent loss.

When the user's IL is compensated, the remaining BNT tokens are burned.

Here is a chart to illustrate this :

This is how Bancor works. This system is quite ingenious and allows users to be protected against impermanent loss, unlike other protocols where you can be fully exposed to IL.

However, there are still risks and issues to consider, as we will discuss in the next section.

Part III. Risks and issues related to Bancor

Here are some issues and risks we may face when using the protocol

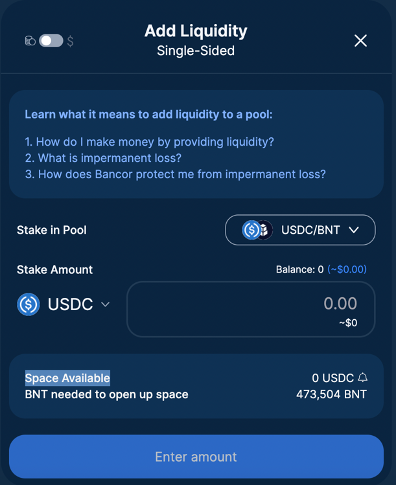

- Deposit are limited

Indeed, first come and first served applies here. Each liquidity pool is limited to a specific amount. Once this amount is reached, it is not possible to add additional liquidity. Here is an example with USDC :

We can see that the "space available" is at 0 right now, meaning that the pool is full. The only way to deposit USDC again is waiting for others to add BNT tokens into this pool. We can see that we need to add 473,504 BNT to open up space for USDC.

Of course, it limits access to users, but it allows keeping attractive returns for those who were able to deposit.

- In order to get full protection against IL, you must observe a minimum period of time.

If you decide to withdraw your deposit before the first 30 days, you won’t get any protection against impermanent loss. Besides that, the protection rate increases by 1% every day.

In practical terms, this is what it looks like:

- exit before the first 30 days: 0% protection

- exit after 31 days: 31% protection against IL

- exit after 100 days or more: 100% protection against IL

Therefore, before making any decision, you should take into account that your deposit must be a long-term deposit of at least 100 days to be sure to be protected against IL.

The good news is that this system will change with Bancor v3, protection against IL will be immediate.

- APRs are calculated over the last 24 hours, and therefore vary widely and often

It will depend on the trading activity in the liquidity pools, if there's been a lot of activity the last 24 hours, this has generated a lot of trading fees and therefore increased the APR. That's why you should be aware that this rate may (will) change regularly. Nevertheless Bancor's rates are amongthe most attractive on the market, especially since you can take advantage of their liquidity mining program.

- Finally, the risks that apply to all DeFi protocols: the risks of hacking and technological risks.

This was the presentation of Bancor. This protocol is very promising as it presents interesting mechanisms and is an excellent solution for people who wish to deposit assets without touching them for a long period of time (100 days) while being protected against impermanent losses.

We hope that you enjoyed this article.

- 🇺🇸🇬🇧 refinements by @0x_Groova -