Article by @leo5imon

Disclaimer : The information provided in

this article does not constitute investment advice, financial advice, or

any other sort of advice and you should not treat any of the website's

content as such. Do your own research and remember this information is

provided for educational purposes only.

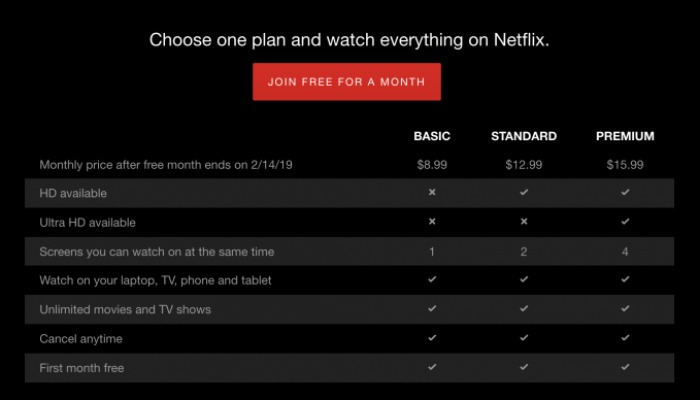

The subscription system has become the default model on the Internet : pay a certain amount each month to access a specific service.

NFT have changed the meta, by proposing a different model on several aspects :

- Dynamic pricing, allowing you to gauge demand for your product / service based on the market response.

- Secondary market fees, giving access to income with each secondary sales of your NFT.

- An open market, allowing buyers to both bet on you - and be able to jump off the ship at any time - while making money.

→ Imagine having invested in a Netflix subscription when they launched !

Nevertheless, being in its infancy, the so-called "utility" NFT market has some shortcomings. One of them is the possibility that the creator of the NFT stops offering the service - and the NFT is no longer worth anything.

The other is that the service is so valuable that buyers no longer want to resell it, preventing the creator from earning the creator from getting any revenue.

Having launched two such collections myself with thousands of dollars in volume, I've been thinking about the implications and an experimentation that could improve this system.

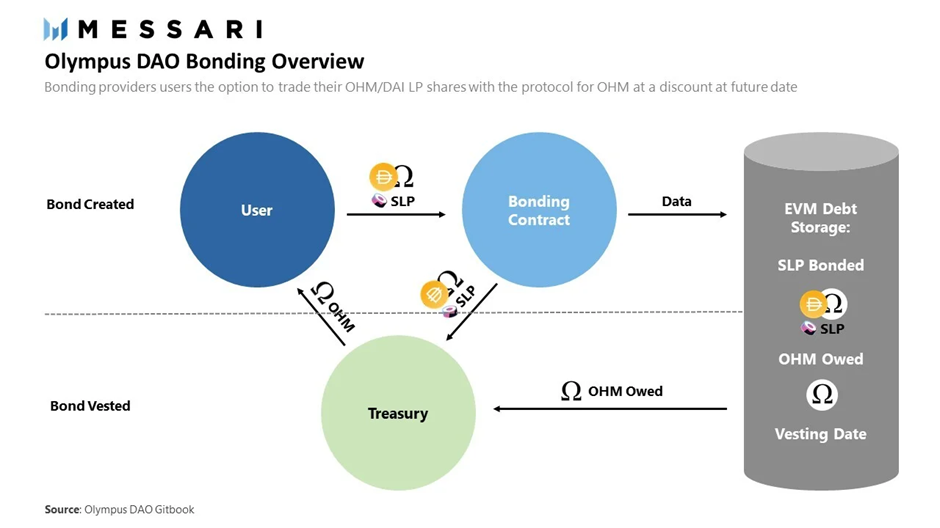

The idea is to use the mechanics introduced by OlympusDAO in a utility NFT system.

The launch would be at a low price : 0.01 ETH, 1 MATIC, etc. The money acquired through this launch would go directly into a smart-contract, allowing it to support the NFT pricing.

Then, the market would set the price of the NFT as it does every time : if more people want to have access to the creator's services, the price increases. Each sale automatically includes a fee, usually 10%. A part of these fees would go into the "backing" smart-contract - and the rest would be used to pay the creator.

If one of the buyers wants to recover his initial stake and his accrued fees, he could at any time "destroy" his NFT and recover the stake. The NFT is backed and allows its buyer to receive programmatically revenues, based on the success of the project.

The concept can also allow the owners of this NFT to vote on the financial policy : increase the percentages on each sale ? Use free cash flow for yield farming, ...

The DAO formed around this NFT could also choose to issue new NFT at the floor price (or cheaper, a bit like a bond system) - allowing it to raise funds and avoiding dilution.

This idea seems to me to be an obvious one to finally combine the possibilities of NFT with those of decentralized finance. If someone wishes to develop the idea, please do not hesitate to do so and send me your results !