Article by @0xKvmi

Disclaimer : The information provided in

this article does not constitute investment advice, financial advice, or

any other sort of advice and you should not treat any of the website's

content as such. Do your own research and remember this information is

provided for educational purposes only.

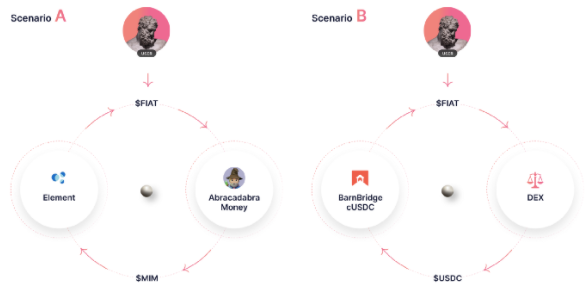

FiatDAO ($FDT) is a protocol which enables borrowing against fixed yield and using leverage to make yield more efficient and/or access liquidity. For some time now, a multitude of projects allowing fixed returns have been emerging.. (Barnbridge, Element, Notional, Pendle..).These projects allow you to lock tokens for a fixed period of time to earn a fixed return.

Contributors of Barnbridge protocol then had the idea to launch FiatDAO to allow users to take advantage of a leveraging system. The project is incubated by Barnbridge.

Let’s say I lock my tokens in one of the fixed yield protocols mentioned before. I can now use my proof of locked position as collateral and borrow liquidity while I'm still generating yield. These assets are called Zero-Coupon-Bonds (ZCB). FiatDAO allows to, in exchange for these ZCB, mint an ERC20 token called $FIAT which is intended to be stable. Beware, this is not a stable coin which is designed to be as close as possible to $1.

With Zeus as advisor, the project is closely related to Olympus, and guess what? The v2 bonds have just been released and are by definition usable in FiatDAO as collateral. A partnership proposal has just been accepted on the Olympus forum too.

The token is already available on Olympus pro. Contracts and dApp are being audited.

Oh, I almost forgot : sub $20M mcap.

If you want to dig more on the mechanics behind this, shares, and other big brain concepts you can read more on Fiat DAO's medium

- 🇺🇸🇬🇧 refinements by @0x_Groova -