Article by @0xgp_

Disclaimer : The information provided in this article does not constitute investment advice, financial advice, or any other sort of advice and you should not treat any of the website's content as such. Do your own research and remember this information is provided for educational purposes only.

A lending market with 0% interest rate : this is what Qi Dao offers. In this article we will explore how to use their platform and what it can offer you, compared to platforms like Aave or Compound.

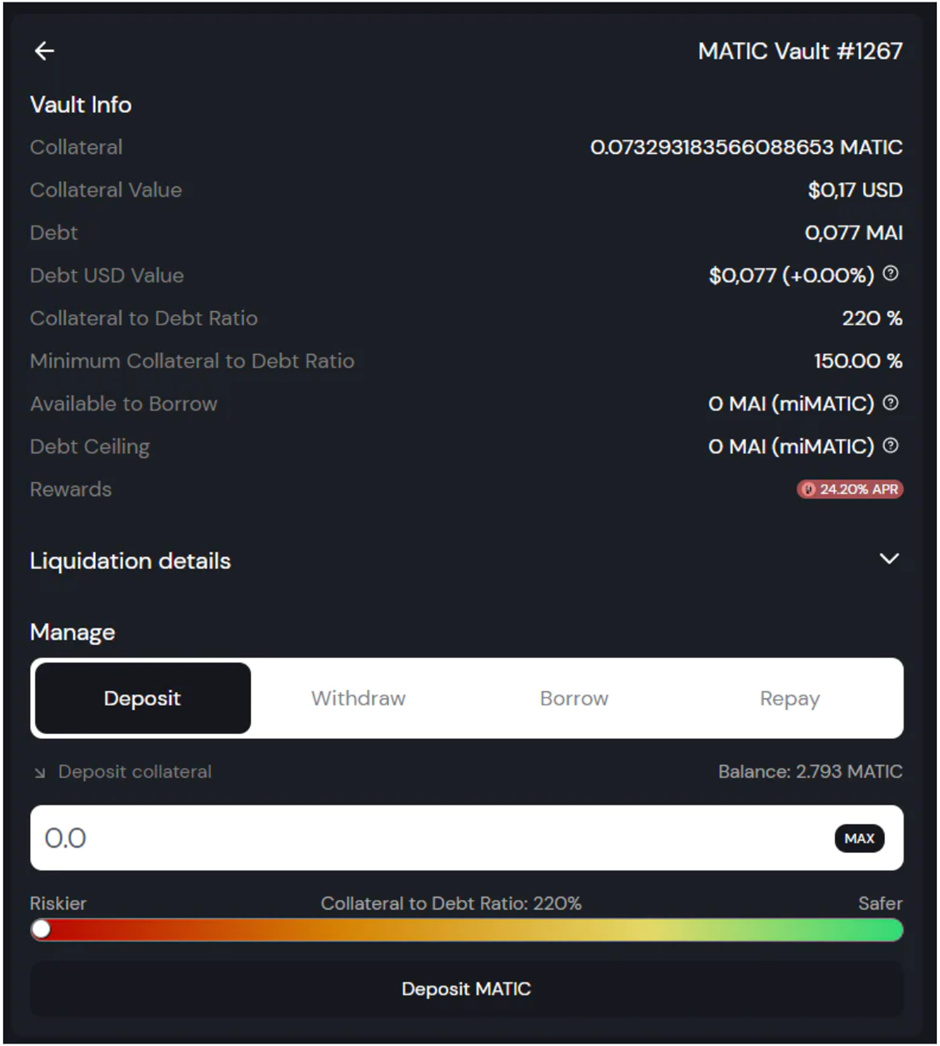

As an introduction, Qi Dao protocol aka mai.finance allows you to borrow a dollar-backed stablecoin ($MAI) based on the collateral you have deposited.

Once you have borrowed, you can do whatever you want with your $MAI : swap it for $USDC for yield farming, invest on another project, build a loop by depositing again for more collateral…

To use the platform, it is essential to understand several concepts and to appreciate the risk of a loan market as well as the benefits it can bring.

The benefit of a lending market is that you do not need to sell your speculative assets ($ETH, $MATIC, $AVAX, $LUNA) whilst accessing the purchasing power of stablecoins in the meantime.

E.g : I’m bullish on $ETH, I can deposit them on a lending market to borrow stables and use them in farming, invest in projects…

It is therefore a very powerful tool, which allows you to maintain “long term bags”, while having the ability to make short-term moves which could greatly outperform your collateral ROI.

Now let’s talk about the risks. Like any DeFi platform, you are exposed to risks related to smart contracts (hack, exploit). Market fluctuations and oracle errors are also risks to consider before entering a lending market.

The most obvious risk in lending markets is liquidation risk. To get a loan from a lending platform, you deposit a volatile asset (in most cases) and you borrow a stable token. If the value of the deposited token drops, the protocol will liquidate your collateral to avoid a deficit.

On the other hand, if the deposited asset value fluctuates upwards, this gives you a greater borrowing capacity or at least a greater margin before liquidation.

I wrote an article about Aave, this is a practical example about a lending market use, to accumulate more of the deposited token :

https://mirror.xyz/0xgp.eth/bGflsjciED8pMkp3ML42l72VgAjOqX0HsbtmauuuMzI

What is the difference between two lending markets like Qi Dao and Aave ?

It’s pretty simple, on Qi Dao you can borrow with 0% interest rate for an indefinite period of time, unlike Aave where you will be paid for lending tokens, or you will have to pay to borrow.

I really like Qi Dao a lot for this particularity, the only fee is paid when you withdraw, 0.5% of your collateral.

It is very useful if you want to adopt a long-term lending/borrowing strategy.

But the other special feature of Qi Dao is that you can gain rewards in $QI if your borrowing rate is within a certain range, between 10 and 60% APR depending on the token deposited.

It’s very wise to have such a system in place : On the one side, this protects the user who is incentivized to avoid liquidation by not borrowing too much. On the other side it is an increased stability for the $MAI stablecoin.

Also, (just my personal take here..) accumulating $QI is a smart move, with the above mechanism, we can think one day of lending market gauges (wen veQI ?) and I think you have seen what happened with Curve.

Finally, this is not the only advantage for using Qi Dao, you can also deposit “yield bearing assets” as collateral, or otherwise assets generating yield.

Because of this, your collateral will automatically generate yield that will let you borrow more, or have a larger liquidation margin.

- Anchor : an arbitrage module for $MAI

- Farm : pool listing for yield farming

- Yield : transform tokens in “yield bearing asset” via Aave

- Boost : rewards for $QI staking and a vote power (almost 100% of APRs come from fees generated in the platform)

- Reward : well... rewards

- Bond : a more recent functionality, following OHM model, you deposit liquidity against a premium on $QI

After having exposed the pros of the platform, it’s essential to speak about some cons, not seen in Aave (for example).

First of all, it’s a recent protocol, it’s less “battle tested” and less secure than Aave or Compound for example, even if the team behind is on the right track.

Some could say that the protocol is not optimized, because LTV (Loan To Value) - the total possible borrowing is way smaller : 70% for $ETH and you get liquidated at 70%, whereas on Aave you get 82.5% LTV and get liquidated at 85%.

This may seem like enough, but for someone who has the time and tools to manage their positions, it represents 10% of “non efficient” capital.

I would advise them and anyone else who wants to try out lending markets to go for Qi DAO and for the most experienced to go for Aave or something like Liquidity, which is also a very interesting solution (with some other parameters).

In conclusion, I invite everyone to try at least one platform in the lending market (even with little funds) to understand how they work.

It can help you maximize your capital exponentially. However, there are risks associated with it, and it is very important to understand them.

For the most experienced, loops are possible on this platform, this is called “leveraging” a position and as in trading, use with caution.

To me, Qi Dao has a great future because it is a protocol that is starting up on more and more chains, that has very interesting partnerships, and it is a more robust product than Abracadabra which is more "degen" oriented.

- 🇺🇸🇬🇧 refinements by @0x_Groova -