Disclaimer : The information provided in

this article does not constitute investment advice, financial advice, or

any other sort of advice and you should not treat any of the website's

content as such. Do your own research and remember this information is

provided for educational purposes only.

Crypto is drowning, some get liquidated, others panic close their positions.

THE MARKET IS BLOODY RED!

Is this the comeback of the well-known bear market again? The purpose of this article is to share my personal view on the overall situation and how it may evolve in the near future.

I’ll be using the BTC chart to describe the crypto market. Don’t blame me for this.

It’s daddy after all.

By @GGreedy

1. Is crypto dead already?

Hell no! At least I hope…

The question of a new bear market has risen, and for a good reason: the whole

Crypto market is dumping and it’s hurting a lot of people. Most people lose their temper and start to enter FUD mode.

We are approximate~50% down from the top after a slight break of the last ATH from MAY 2021. This drop looks strangely alike the MAY crash and when it happened it was a similar pattern as we faced before the drop.

BTC was on a home run, ALTS season was on fire, NFT season was gold then came the shitcoin season + fork season on the BSC that ended with many rugs and finally a huge crash.

From mid-July 2021, BTC went back on the bullish tracks, alts outperformed by crushing their ATH by far, NFT season was lit once again, and then came the dog and meme coin season again + the fOHM season (and a few others like nodes but less popular) then what?

Yep, you got it, a new crash. I wrote this article (in French) by warning about a similar pattern and the chances of a new crash.

After the May crash, the price did not turn into a slow bear market and slowly showed accumulation and recovering signs and then pumped (led by alts).

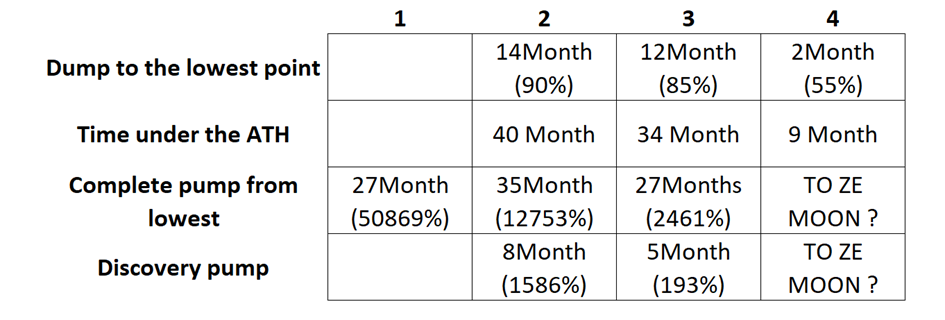

The small data that we have from the past move talks for itself: the more we grow, the % gain decreases, and the weaker the correction/dump is. It’s a very small piece of data, the reliability is so, not perfect. But it is still useful and needs to be implemented into our analysis.

Select an Image

I will go deeper Into the explanation of why the dumps might be weaker and weaker over time later in this article.

2. The diffusion of innovation

“The blockchain and the technology behind it, is going to change the world, it’s a new paradigm”

We heard it a lot lately, and it might be true. If you’re reading this, you probably jumped in this "new paradigm" ride.

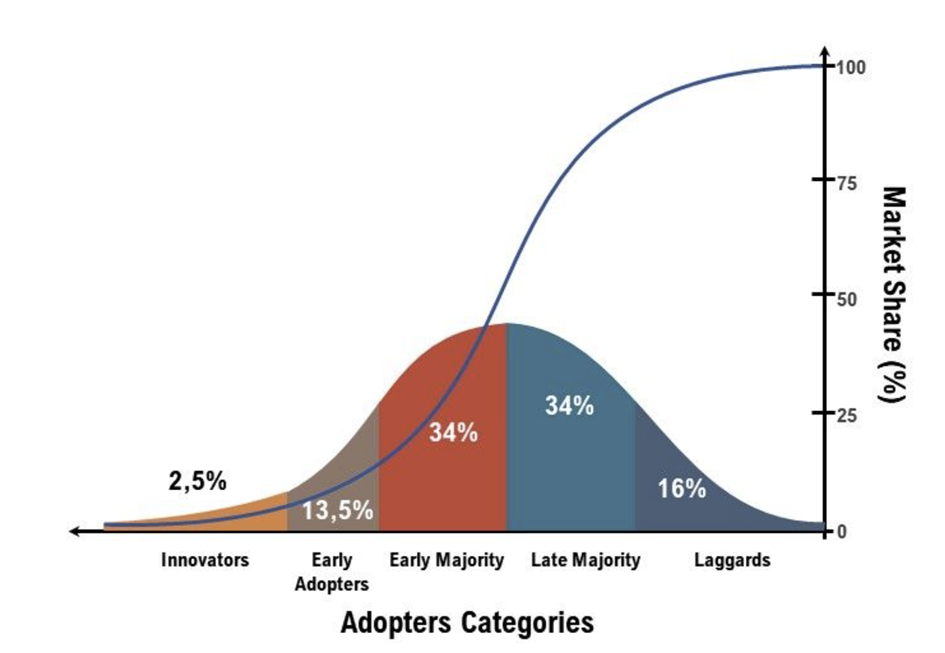

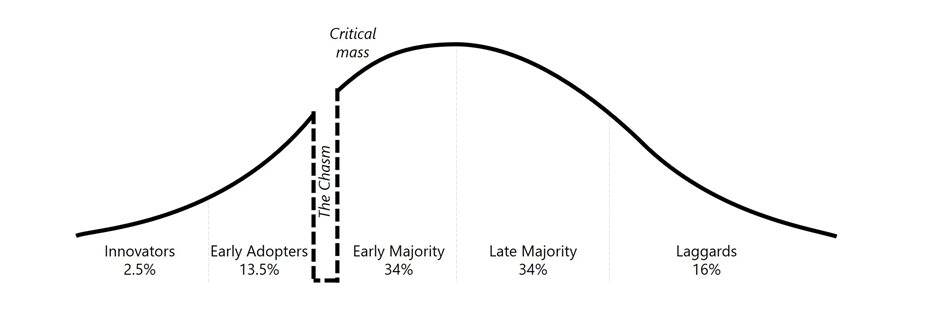

You probably have heard of something called “the diffusion of innovation” or seen the chart that represents it:

I appreciate the use of this chart regarding how accurate it is to evaluate the adoption of any new technology, service, product, and even paradigm.

Here is a brief explanation of each phase even though they speak for themselves.

Innovators: These people are the ones behind the myth. They are building something new and are the first to believe in innovation. Some people which are not part of the builders/innovators are also considered in this category as they are willing to take the risk to be the first to jump in.

Early adopters: These people are somehow aware of the need to change and see a potential bright solution. They are aware of the risk but they are very comfortable adopting new ideas and seeing the potential returns.

Early Majority: These people are the ones that don’t take too much risk as they adopt new ideas only after seeing solid evidence that the innovation is reliable and works.

Late majority and laggards: These are the ones that are pretty late and need a lot of time to adapt to something new and not mainstream yet.

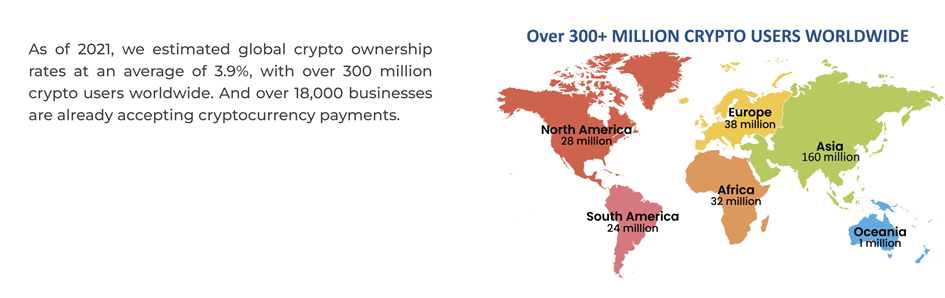

Only 3,9% of the population is using or has used crypto, which is a pretty small number. If all this would be a paradigm as the internet was, this would put us between the innovator’s category or at least the early of the adopters.

From this point, it’s promising in terms of evolution (only if all this game was not a scam and crypto is not going to 0 from now).

BUT, can’t we already be within the early majority group?

I doubt so, especially when I see that the big tech name like Musk and Tesla, MicroStrategy, major traditional hedge funds, and many more lately, publicly announcing their interest and path to join the crypto ride. These kinds of players are at the top of the tech, and would never be that late in such a “revolution”.

After all, even if we were there, we would be safe as we still have the late majority and laggards to join the ride as exit liquidity.

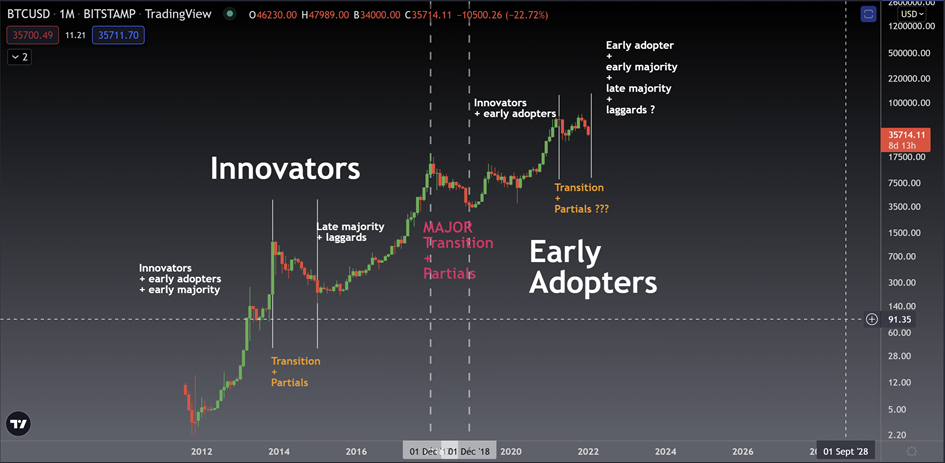

From now on, I’d like to develop and cross this “adoption of innovation” graph with the crypto market.

My point of view on this possible correlation :

- Each Phase is cut into 3 phases (law of cycles). Impulsion, correction, and impulsion again.

- A pump might be caused by the arrival of a new group of people

- At the end of each phase, we might have a major transition phase

- Each new phase might last longer than the previous one

- The more we grow the less the impact of the major transitions will be big (in terms of %)

- The time to achieve a new major transition should increase over the evolution, but it can be smooth and short depending on the overall situation. But for sure, a proportional correction will be needed somewhen.

- Taking into consideration the fractal law, we can divide each phase with internal phases.

3. Too big to crash that hard: new people, new investment behaviors, and strategies over the long run

As the crypto market evolves, the number of people grows, we need to understand who these people are, why they are here, their behavior, and investment strategies

Understanding who the actors of a market are and why they are here can be helpful to anticipate what they might think and what actions they might take in the future.

A. The innovators

Here for the tech from the very beginning. Have a long-term vision and will only take partial profits along the way up. The more the market grows, the more their power on the market grows. They might be up for some manipulation.

B. The random holders

People that were chilling deep on the internet were able to acquire some bitcoins through forums, surveys, or games. They did not recognize the value of it at that time and did not understand the tech at all. Found out that they had some money sleeping when the media start talking about BTC and cryptos and sold their profits or holding for fun (if they were able to find their accounts holding their bitcoins). Might not have a lot of impact on the market.

C. Long term serious early adopters

These people believe in the tech, know the risks and the ROI associated with it. They are ready to jump in for the long ride. They will take partials along the way but will always want to accumulate as much as possible. Might have a background in tech or some basic investments skills from previous experience which makes them look more serious than flippers early adopters.

D. Flippers early adopters

Hereby chance because they have a friend that suggests looking into BTC and crypto because money can be made $$. Basically will have a try, might be greedy at some point, if it goes well, might be overinvesting but will try to be on the track for as long as possible. The more they stay the more they will gain experience and will try to optimize their skills for profits. They migh have some background in investment and know how it works.

E. BIG PLAYERS early adopters

These are the ones with a lot of money. Professional investors, Hedge Fund, banks, huge companies … are here because they see a huge potential and agree with the tech. They know what they are doing and might abuse their power through manipulation. They will optimize their profits and risks with hedges and manipulations. They will always want to accumulate as much as possible when the price will drop low.

F. Newbies early adopters

Here because they saw the money that can be made through the media and friend talks. No knowledge in investments, risk management, just throws money in and pray. Attracted by fast and huge profits so they will instantly be attracted by leverage has a path to become rich from nothing. Will gain some money but will give it back to the market somewhen. Might acquire skills and passion and transfer to a different group of investors.

G. Wen Early majority?

Might be there pretty soon.

The more the crypto market grows, the more people that would be categorized as newbies or flippers might be converted to wise investors. Because the profits that they can gain create interest in understanding the ecosystem and building skills linked to the blockchain. They reinforce the tech and the long-term vision which is a good point for the capacity of the crypto to hold and stay strong during the correction phases.

The stronger the market is, the weaker the dumps. This is partly why I don’t believe in an 80% or 90% crash of the BTC.

4. And what if it was the crash, the bear market ?

No one can be 100% sure of what is going on right now and what will happen. Wise investors need to make a statement for both sides, BULL and BEAR.

Since now, I gave bullish arguments to defend the position of a simple correction that might not last too long. But they are obvious arguments to defend the possibility of a bear market.

A. The overall economic situation

It’s not a secret that the actual economy is unstable and depends mostly on debt. Taking credits to repay the debt and being able to move forward is trying to dodge the problem.

This will not last and there will be consequences someday. But as the FED remains active with their printing machine, we are good. Inflation is something that gets a lot of concerns as well, but it might be maintained (as much as possible) for some time.

B. The geopolitical situation

COVID is still there and pissing everyone off with all that comes with it (restrictions, pass, vaccines…), the tensions in Ukraine, Kazakhstan. Something that can lead to something worse? Maybe, that’s why we need to stay updated on the situation.

C. Over leveraged (Open interest)

Leverage is like debt in the real world. Too much is never a good thing, especially in a such young market. It creates a reason for manipulators to do what they are best at. But as debt, we will never be able to liquidate everyone and start from a fresh and nice start.

D. Time under ATH

We didn’t spend a lot of time under the ATH, which is something that might happen someday. The market just can’t make new highs over and over, it needs to breathe. The consolidation phase is only 9 months today, which is quite small compared to the data from past consolidations (40 and 34 months).

E. The possibility of the chasm?

The chasm would be a major point. Getting through it would mean a possible mass adoption and bright days, not passing through would mean “we are fucked”. This is not something new as a lot of innovation fails to reach the majority even if their product or service is excellent. We need to take this possibility as a possibility because if it may happen, this would mean 0. Interdictions related to crypto in some of the major countries could be painful if they are not changing their approach to something more friendly.

5. My scenarios

I keep a bullish bias. I don’t see price crashing for too long. It can crash more in terms of %, but I don’t expect it to be too long, more like a flash crash.

1st scenario: We are in an interesting zone for buys. This zone is where I’ll be using 85% of my available liquidity to position myself on different cryptos.

2nd scenario: Price can’t go down forever, especially in a stronger market. Crypto is not as weak as it used to be before, new strong actors have joined the ride and this gives them the power to respect the cycles, even in a bearish move. Price can react to the DCA zone, but not for long, and crash after. This has to be a possibility, momentum will be the key.

3rd scenario: This one is the one that everyone fears but that must be taken into account. IT CAN HAPPEN, even more, because manipulators would love to push the price lower to get a better entry point. If it happens, I would see a huge momentum for a bullish move after that as shorter would take profits at the same time and close their position (major low is a TP).

This is my personal opinion and my plans that I’m respecting, it’s not a piece of financial advice, Invest at your own risk.

WGMI?