Article by @0xgp_

Disclaimer : The information provided in

this article does not constitute investment advice, financial advice, or

any other sort of advice and you should not treat any of the website's

content as such. Do your own research and remember this information is

provided for educational purposes only.

Stablecoins are essential in the crypto world. What are they made for, what are their differences, and how to make profit with them ?

The stablecoin is a cryptocurrency in itself which aims to have a stable value, it is most of the time backed by a fiat currency ($, €, etc.) and it has to stick to its value via different algorithmic or collateralization mechanisms.

There are a variety of use case :

- Protect against crypto volatility

- Cross-chain use

- In DeFi / CeFi / CeDeFi for yields

- Stablecoins are not subject to tax

Generally speaking, for a stablecoin to make it through time, a few ideas should be kept in mind :

- Its conception and mechanisms

- The issuer

- The trust people place in it

- Its use case

There are a dozen of them, but we can list them in 4 categories :

- 100% fiat backed stablecoins

- 100% backed or over backed by crypto

- 100% algorithmic stablecoins

- Semi-algorithmic stablecoins

USDC, USDT and BUSD are 100% fiat backed, it means each time an USDC is minted, $1 is put into receivership, in a Circle’s bank account for the USDC for example.

On the other side, when the circulating supply is no longer the same as the demand, USDC are burnt and $ are liberated.

Their value is totally guaranteed, as long as the balance between minted USDC and locked $ in banks is fair. Some people could see a problem because fiat is centralized, and this is what DAI and UST are trying to avoid, but before we get to that part…

Maybe you heard about the USDT case, and despite the scandal in this story, the stable coin never loses its peg and is always the most used. Why ? Its enormous popularity and adoption.

As stated previously, lack of decentralization bears a real risk, even at low probability : the issuer has control over its asset's future, he can modify it, delete it, forbid the exchange or just the selling. That’s where the urge for decentralization comes from.

Crypto collateralized or over-collateralized stablecoins : sUSD (by Synthetix) or DAI (by MakerDAO). These assets provide a reliable decentralization and should maintain their peg as efficiently as fiat collateralized stablecoins. Any Achilles' heel ?

These stablecoins are not capital efficient, meaning that we get less money in output than what is deposited to create them in input. This system guarantees a sort of security for the protocol : it’s “over-collateralization”.

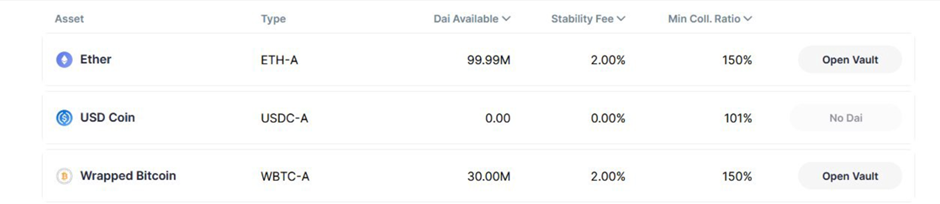

The DAI, decentralized stablecoin by MakerDAO works on the same principle, but instead of $ in a bank, it’s Ether or any other ERC-20 asset chosen by vote of $MKR holders which put their tokens in receivership.

You have to deposit between 101 and 175% of collateral to mint DAI, as cryptocurrencies are more volatile than fiat, MakerDAO protocol guarantees a margin in case of big price moves. It also manages liquidations the same way to avoid debt.

Some example of minimum collateral and list of ERC-20 assets (note that you can also deposit LP as collateral, more info here https://oasis.app) :

Let’s now talk about algorithmic stablecoins. To stabilize an asset, only thanks to ingenious mechanisms and without any collateral. This is a real challenge that many crypto players are trying or have tried.

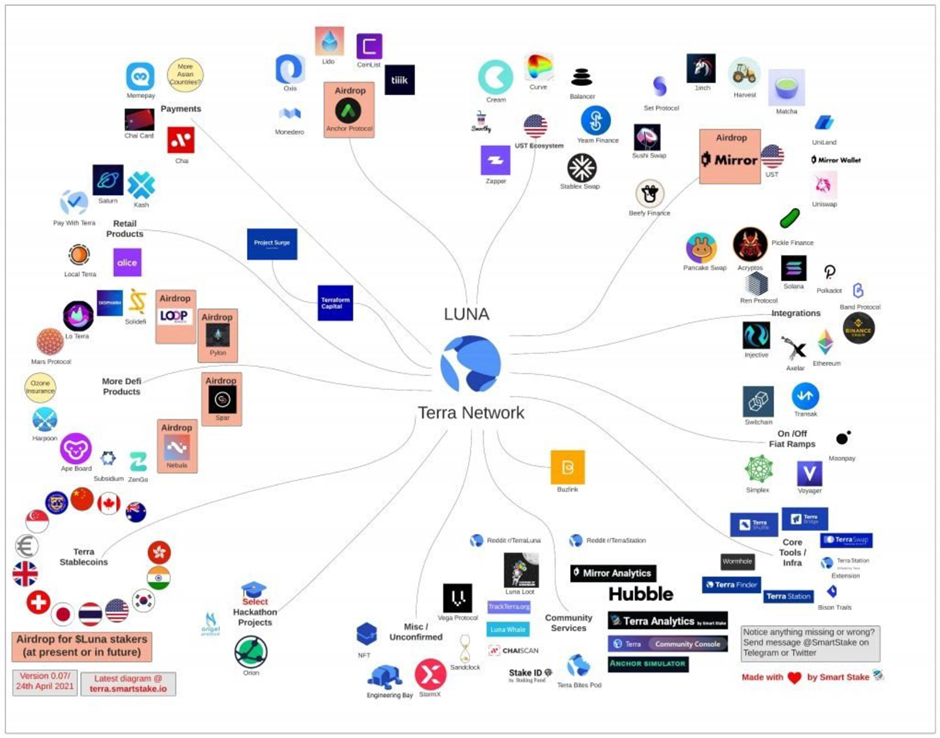

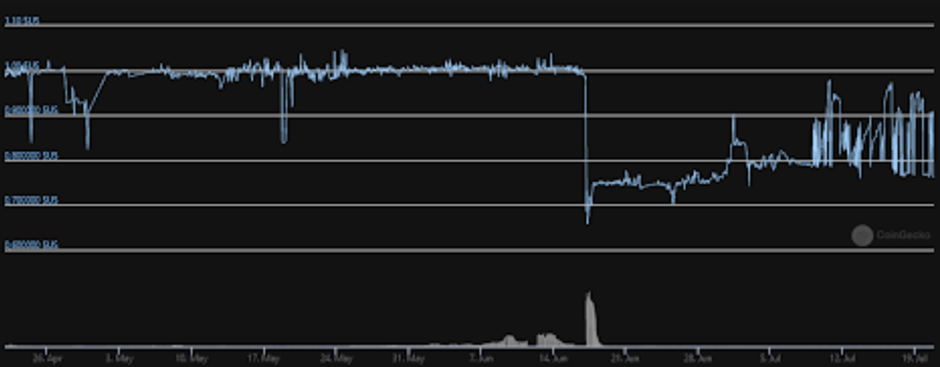

UST is probably the most known, the decentralized stablecoin of Terra ecosystem ($LUNA). It probably is the one that has succeeded the best, with a big fright in January 2021. How to explain this success ?

- A very ingenious mechanism : for each UST minted, the same amount of $LUNA is burnt and vice-versa. This process allows volatility on the LUNA token instead of on the UST.

- An ecosystem that develops around UST : Anchor, Mirror, Pylon. All the next projects of Terra Ecosystem revolve around the UST stablecoin, which contributes to its stability.

- A desire for interoperability above all.

- An adoption in the real world, with payment solutions, already used in Korea for example.

Semi-algorithmics stablecoins : they combine the two previous aspects, which are collateralization and algorithmic mechanisms. They provide the possibility to under-collateralize, as opposed to the DAI, in order to give better arbitrage windows and DeFi yields.

But somehow, like the 100% algo-stables, they stay vulnerable to bank-run phenomena and their long term viability is really built through live market stress-tests.

Two good examples of semi-algo stables are $FRAX which for now fulfill its role (https://frax.finance) and $IRON, victim of its success or unviable in the long term ?

https://rekt.news/iron-finance-rekt/

One thing is certain for these promising projects, their future will not only depend on peg mechanisms, but mainly on consumers' education, trust, and communities.

If we had to compare the differences between stablecoins types, we could start with this chart :

It’s also important to remember that for a lot of DeFi protocols like Aave, Compound, OlympusDAO, a un-peg of DAI would initiate massive liquidations and losses. Stability is a major concern here.

We can hope for DeFi that one day, it finds the perfect stablecoin combining decentralization, cost efficiency and stability.

Thank you for reading this article !

- 🇺🇸🇬🇧 refinements by @0x_Groova -